Key Benefits of Gold Investment

Discover why gold continues to be a resilient asset in Pakistan's financial landscape

Inflation Hedge

Gold has historically maintained its value against inflation, making it an excellent hedge during periods of currency devaluation. In Pakistan, where the rupee has faced significant pressure, gold investments have provided substantial protection against purchasing power erosion. The precious metal's value tends to rise when national currencies weaken, offering a reliable store of value during economic uncertainties.

Portfolio Diversification

Adding gold to your investment portfolio creates essential diversification that can reduce overall risk. Gold typically moves independently of stock markets and other financial assets, providing balance during market downturns. For Pakistani investors, maintaining 10-15% of a portfolio in gold has proven to be an effective strategy for weathering economic volatility. This diversification benefit becomes particularly valuable during periods of market stress or geopolitical tension.

High Liquidity

Gold enjoys exceptional liquidity in Pakistani markets, with well-established buying and selling channels across the country. Whether through jewelers, banks, or dedicated gold traders, investors can quickly convert their gold holdings to cash when needed. This high liquidity makes gold particularly attractive compared to other investments like real estate, which may take months to sell. The deep cultural significance of gold in Pakistan further supports its market liquidity and consistent demand.

Long-Term Value

Gold has consistently demonstrated its ability to preserve wealth over generations. When analyzing Pakistan's economic history, gold has maintained purchasing power through multiple financial crises, political transitions, and currency devaluations. For long-term investors in Pakistan, gold provides a reliable store of value that transcends short-term market fluctuations. Historical data shows that gold has outperformed the Pakistani rupee significantly over any 20-year period examined.

Cultural Significance

Gold holds profound cultural importance in Pakistan, particularly for weddings, celebrations, and as family heirlooms. This cultural significance creates a persistent demand base that supports gold's value regardless of economic conditions. Pakistani families often view gold jewelry not just as adornment but as a tangible investment that can be passed down through generations. This dual-purpose nature of gold as both jewelry and investment makes it uniquely positioned in Pakistan's investment landscape.

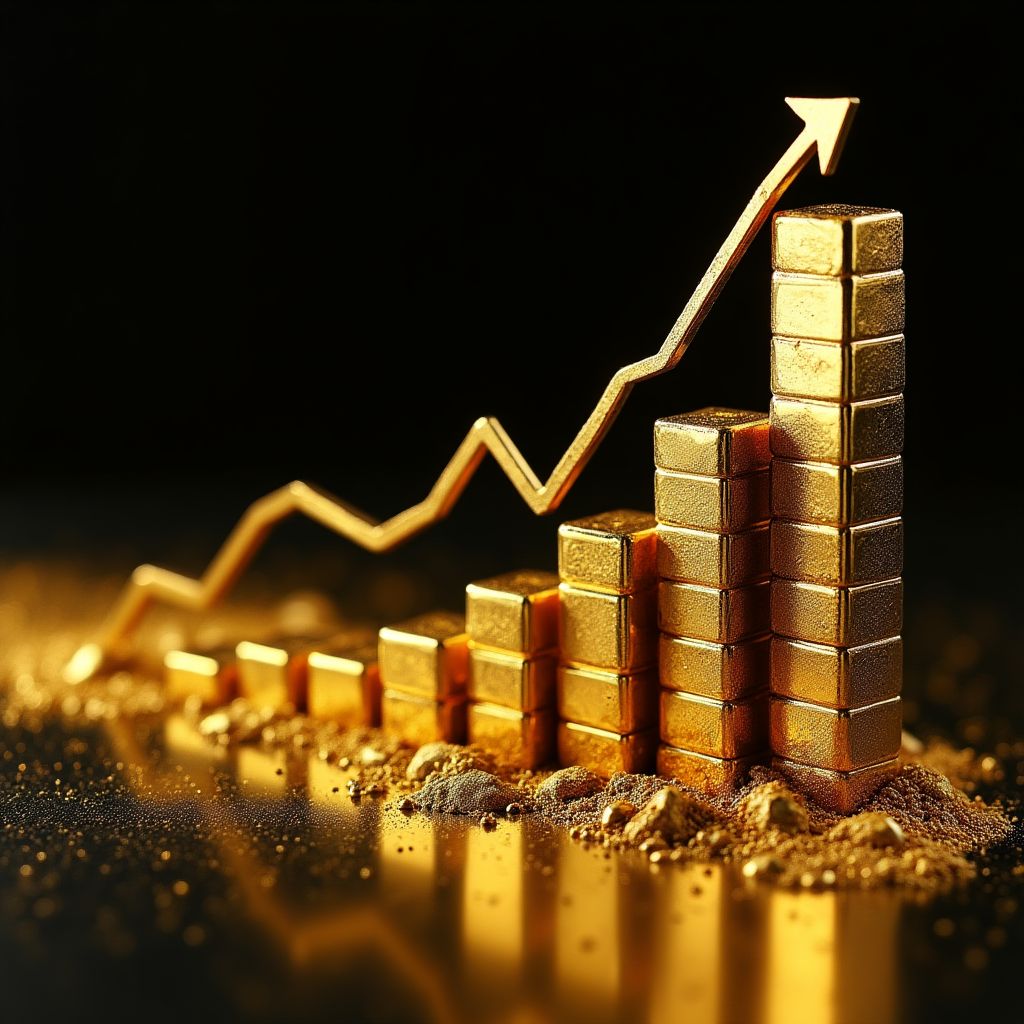

Crisis Protection

During periods of economic or political uncertainty, gold has consistently served as a safe haven asset for Pakistani investors. Market data shows that gold prices typically surge during times of crisis, providing crucial portfolio protection. The COVID-19 pandemic offered a recent example, with gold prices in Pakistan reaching record highs as investors sought safety from market volatility. This crisis protection function becomes increasingly valuable in Pakistan's sometimes turbulent economic environment.